Hot on the heels of Donald Trump’s victory in the US presidential election was an important meeting of the US Federal Reserve’s Federal Open Markets Committee (FOMC) on November 6 and 7.

At the meeting, the committee decided to lower the benchmark rate by 25 basis points to 4.5 to 4.75 percent. This marks the second cut by the FOMC, which made an outsized 50 point cut at its last meeting in September.

The rate cuts have come as inflation has cooled towards the 2 percent target set by the Fed when it first began raising interest rates in February 2022. While the personal consumption expenditure index for September had fallen to an overall 2.1 percent increase year-over-year, the committee was still concerned about some stickiness, as the PCE less food and energy prices was up 2.7 percent.

A key factor influencing the Federal Reserve’s decision is the current state of the jobs market, which has stabilized significantly. Labor market conditions are now less constrained than they were before the pandemic in 2019, reducing its contribution to inflationary pressures. As a result, the central bank has been able to shift its focus within its dual mandate of promoting maximum employment and maintaining stable prices.

In his statement following the decision, Federal Reserve Chairman Jerome Powell suggested that while he thinks the economy and policy are in a very good position, there is still some uncertainty. He said the data would inform future rate decisions, and the FOMC would react appropriately.

“We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time, reducing policy restraint too slowly could unduly weaken economic activity and employment,” Powell said. “We are not on any preset course. We will continue to make our decisions meeting by meeting.”

The election results bore little influence over the decision at the November meeting. When asked how election results may affect future rate decisions, Chairman Powell suggested there would be no influence in the short term.

“We don’t know what the timing and substance of any policy changes will be,” he said. “We therefore don’t know what the effects on the economy would be, specifically whether and to what extent those policies would matter for the achievement of our goal variables of maximum employment and stable prices.”

While commenting on the longer-term implications of a Trump presidency, Powell was neutral in his remarks, saying any government could implement policies that could have economic effects that would matter over time. Powell said the Fed would take those factors into account in future modelling.

When asked if he was concerned that Trump’s incoming administration would ask him to step down as Chairman of the Federal Reserve, Powell answered “no.” He also said he would not step down before his term ends in 2026. Even though the President is responsible for appointing the Chairman of the central bank, terms are fixed at four years and cannot be overridden.

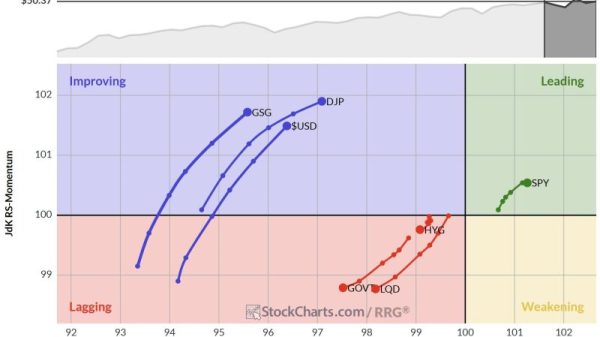

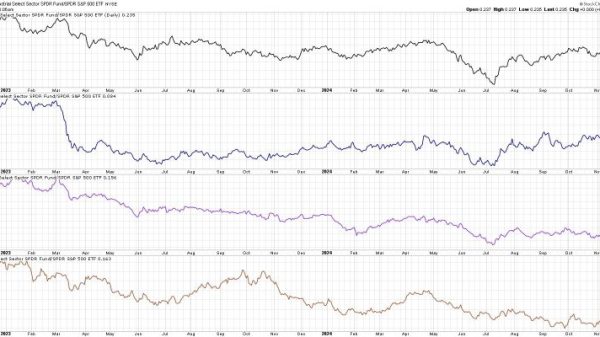

Market reaction to the rate cut decision boosted gold, which climbed by 1.84 percent since markets opened to US$2,707.93 by 3:30 PM EST, while silver surged 3.12 percent to US$32.12.

Equity markets saw slight gains as of that time, with the S&P 500 (INDEXSP:INX) gaining 0.84 percent to 5,978.81, the Nasdaq 100 (INDEXNASDAQ:NDX) adding 1.66 percent to 21,123.64 and the Dow Jones Industrial Average (INDEXDJX:.DJI) increasing 0.15 percent to reach 43,793.06.

How Trump’s policy promises could affect inflation

While Powell did not address Trump’s proposed policies in his statement, if president elect Donald Trump does enact some of the policies he promised frequently in his campaign, it may increase deficit spending and cause further inflation, which could influence future interest rate decisions.

For example, his proposed changes would see tariffs applied broadly to goods entering the United States, which will make everyday goods more costly for Americans. This is because tariffs are paid by importers in the US when they purchase goods from overseas, and the cost increases are passed along to the consumers.

Likewise, sweeping border reform with the promise to deport 20 million undocumented migrants would cost US$88 billion a year to enforce. The impact would be felt by business owners who are already struggling to fill job openings, especially in the agricultural sector. This will likely lead to higher costs at the grocery store or reduced availability of produce.

Additionally, the loss of undocumented workers would see US$100 billion per year in lost tax revenue, requiring the government to increase deficits to pay for government programs.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.