Where might you invest as the year winds down and holiday spending kicks into high gear? A look at historical seasonality trends might help you figure out which sectors tend to outperform in the final months and into the new year.

To begin, the first step is to open up your S&P Sector ETFs ChartLists. If you don’t have an S&P Sectors ChartList, it’s time to create one. My ChartList includes the ETFs listed in the Sector Summary Dashboard panel.

Consumer Discretionary (XLY)

Financials (XLF)

Communications (XLC)

Industrials (XLI)

Technology (XLK)

Real Estate (XLRE)

Utilities (XLU)

Energy (XLE)

Consumer Staples (XLP)

Materials (XLB)

Health Care (XLV)

In the View List As dropdown menu on your ChartList, select Seasonality. When your seasonality chart pops up, you can then select each chart in your sector ChartLists.

Because this is an election year, I am setting each chart to a 10-year lookback period (from 2015 to 2024) to capture three election years. I also view each sector relative to the S&P 500 ($SPX) to set a benchmark comparison (you can set this at the bottom of your seasonality chart in the Compare Symbol To box).

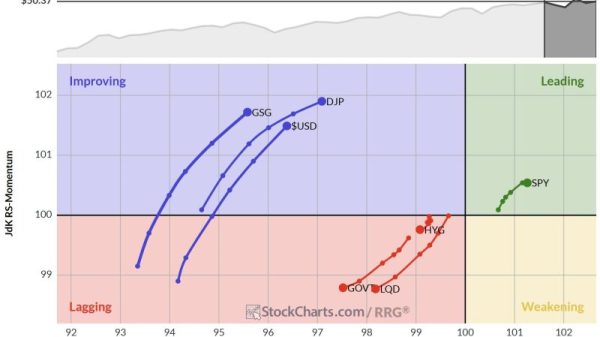

Top Two Sectors to Watch from November to January 2025

If you thought Consumer Discretionary spending might spike from the holiday season to January (considering the beginning of the Q4 earnings season), the results might surprise you.

Remember, we’re looking at entire sectors, not individual stocks that might outperform their sector peers. That said, the two sectors that pop out in a seasonality analysis relative to the S&P 500 are Financials (XLF) and Communications Services (XLC). Take a look at XLF’s seasonal performance (see image below).

FIGURE 1. 10-YEAR SEASONALITY CHART OF XLF. October and November are the strongest months for the Financials relative to the broader market.Image source: StockCharts.com. For educational purposes.

If you bought XLF in August, then you are on the right side of seasonality. November happens to be the strongest seasonal month of the year relative to the broader market. While seasonality alone shouldn’t be the only reason to invest in a given sector, the fundamental and political contexts affecting financials happen to align. Let’s take a look at a daily chart of XLF.

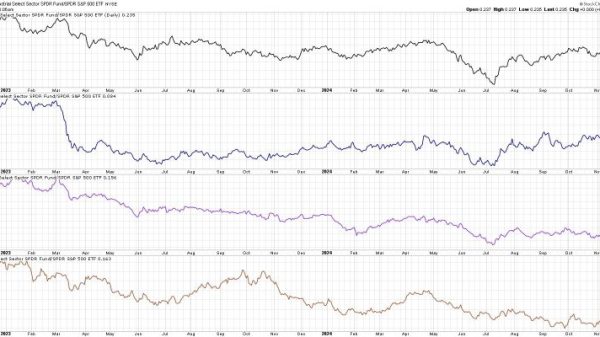

FIGURE 2. DAILY CHART OF XLF. The Bullish Percent Index in the top panel should buying pressure. The divergence in money flow between the On Balance Volume and the Chaikin Money Flow indicates retail traders may be driving prices higher.Chart source: StockCharts.com. For educational purposes.

The Bullish Percent Index (BPI) for the financials sector is soaring above 70%, representing the percentage of stocks experiencing bullish P&F breakouts. However, a BPI over 70% also suggests that the index may be overbought.

Note the divergence between the On Balance Volume (OBV) and the Chaikin Money Flow (CMF). While both measure buying pressure, the CMF can reflect “smart money” activity, since it tracks buying/selling pressure relative to daily price ranges, often capturing institutional accumulation or distribution patterns. If OBV rises while CMF declines, that may signal that retail buyers are driving prices up while institutions quietly sell, suggesting potential weakness in the uptrend.

If you’re expecting a pullback, perhaps to enter or add to an existing position, look to the 20-day and 50-day simple moving averages (SMAs) for a potential bounce. Otherwise, watch support at $46 (see blue dotted line). A close below this level could invalidate the uptrend, fulfilling its seasonal weakness heading into January.

The other outstanding seasonal sector chart was XLC, a proxy for the Communications Services sector.

FIGURE 3. SEASONALITY CHART OF XLC. The January profile reflects an interesting observation.Image source: StockCharts.com. For educational purposes.

This chart is extraordinary.

Over the last 10 years, XLC has had 100% higher closes relative to the S&P 500 in January.

Its average return, relative to the S&P 500, has been 3.1%, marking its strongest relative seasonal month.

November and December may be weak, but they’re the perfect setup for a strong January. But will January 2025 repeat this historical pattern? Shift over to a daily chart for a closer look.

FIGURE 4. DAILY CHART OF XLC. XLC has a similar profile as XLF in that it looks overbought. There could be a pullback in price.Chart source: StockCharts.com. For educational purposes.

Like financials, XLC’s BPI is extremely bullish at nearly 87%, yet this level (over 70%) warns of potential overbought conditions.

The OBV and CMF are also diverging, hinting that retail investors may be driving prices higher, while the smart money may be holding back. Given the seasonality context of a weak November (which, so far, it isn’t) and a tepid December, you might expect XLC to pull back, giving you a strong setup for a January 2025 surge.

Watch the 20-day- and 50-day SMAs as potential support levels in this case. More importantly, keep a close eye on the two swing points at $91.50 and $90, indicated by blue dotted lines on the chart. A close below $90 could signal significant weakness and, unless institutional buying pressure increases, the risk of further downside remains high.

A Few Tips and Tricks

I’ve demonstrated a few ways to use Seasonality Charts to identify seasonality in stocks and sectors.

Drill Down on the Seasonality to Prepare, but Not to Predict: Seasonality charts give you historical context to inform the likelihood of a sector performing a certain way if similar seasonal factors influence the market again. Seasonality is NOT a predictor, but an indicator of possible outcomes that certain factors may historically skew.

Check Sector ETFs Daily Charts: If you’re interested in investing in sector ETFs, then check the daily chart to see if there are any viable entry points.

Drill Down to the Stock Level: If you’re looking at sectors to spot individual stocks, proceed to the stock level. You may want to repeat the process above, as individual stocks may also have their own seasonality depending on factors like earnings cycles, industry-specific trends, or recurring market events.

However, many other ways to apply seasonality charts to your analysis exist. Check out the StockCharts support page on Seasonality Charts and explore how to apply this tool to your analysis.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.